How to Avoid Medicare Payment Reductions in Your Home Health & Hospice Agency

December 30th, 2024

4 min read

By Abigail Karl

As a home health or hospice agency owner, staying on top of Medicare’s rules can feel like navigating a maze. The constant updates, detailed requirements, and potential penalties can leave even the most organized agencies scrambling to stay compliant. And if there’s one thing we all know, it’s this: Medicare payment reductions are no joke.

These reductions can stack up quickly, costing your agency valuable revenue and creating unnecessary financial strain. However, the good news is that with the right knowledge and systems, you can avoid these penalties entirely.

By focusing on four key requirements and implementing effective processes, your agency can remain compliant, protect its bottom line, and continue to provide excellent patient care.

*This article was written in consultation with Mariam Treystman.

At The Home Health Consultant, we specialize in helping agencies like yours navigate the complex world of Medicare regulations. With over 20 years of experience, we’ve guided countless home health and hospice providers in achieving compliance, optimizing their operations, and maintaining financial stability.

In this article, we’ll break down exactly what you need to know to confidently meet Medicare requirements and sidestep the most common pitfalls.

How Much Can Medicare Payment Reductions Really Cost You?

Before we dive into the details, let’s talk about the financial risks your agency could face. Medicare payment reductions might seem small at first glance—1% here, 2% there—but these numbers add up fast. This is especially for smaller agencies.

If your agency earns $1 million annually in Medicare reimbursements, just a 2% reduction would mean $20,000 in lost revenue. Combine that with additional penalties for late submissions or survey non-compliance, and you could be facing tens of thousands of dollars in avoidable losses each year.

The bottom line? Staying organized and meeting Medicare requirements is not just about compliance—it’s about safeguarding your revenue and ensuring financial stability for your agency.

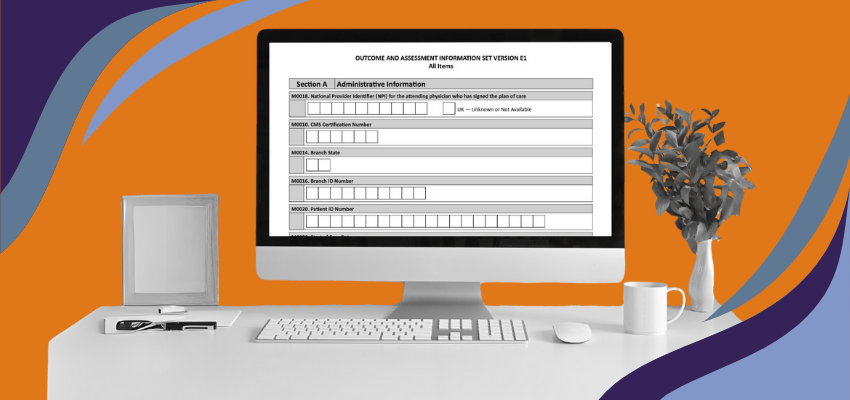

1A. OASIS Submission and How It Affects What You Get Paid

Let’s start with OASIS, the Outcome and Assessment Information Set. Think of OASIS as a roadmap that helps track your patients’ progress during their time in home health care.

At key points—like admission, recertification (60-day check-ins), and discharge—your clinicians gather information about the patient’s medications, mobility, diagnoses, and more. This data isn’t just for record-keeping; it’s Medicare’s way of ensuring quality care is being delivered.

Medicare requires that OASIS data be submitted within 30 days of each evaluation. And it’s not just about generally submitting your data on time. You need to hit a 90% timeliness threshold to avoid a 2% payment reduction.

The good news is that you don’t have to handle this alone. Set up workflows that ensure clinicians complete their evaluations promptly, and make sure your QA team reviews the data for accuracy before submission. These steps can save you from losing thousands of dollars a year.

1B. HIS Submission and How It Affects What You Get Paid

For hospice agencies, the Hospice Item Set (HIS) functions similarly to OASIS in home health. It’s a simpler, scaled-down version but serves the same purpose—tracking patient care and outcomes. Medicare expects this data to be submitted within 30 days, and just like OASIS, the magic number for timeliness is 90%. Fall below that threshold, and you’re looking at a 2% reduction in your annual payments.

Timely submission of HIS data can be challenging, especially when juggling patient needs, but it’s worth it. Think of this as a way to prove the value of the care you provide while protecting your bottom line.

2. CAHPS: Listening to Your Patients Matters

Patient experience plays a huge role in Medicare’s eyes, and that’s where CAHPS (the Consumer Assessment of Healthcare Providers and Systems) surveys come in. These surveys gather feedback from your patients about their experiences with your agency.

If your agency serves fewer than 32 patients per year, you can apply for a waiver. For everyone else, the CAHPS survey is mandatory.

The stakes are high—home health agencies face a 2% reduction for non-compliance, while hospice agencies are hit even harder with a 4% reduction.

The best way to stay compliant? Work with an approved survey vendor to handle the submission process for you. This ensures your patients’ voices are heard and your agency meets Medicare’s expectations.

3. NOA and NOE: Don’t Let Billing Errors Cost You

Billing accuracy might not sound glamorous, but it’s essential. The Notice of Admission (NOA) for home health and the Notice of Election (NOE) for hospice let Medicare know when you’ve started caring for a patient.

Timing is everything here. You have just five days to submit these notices after a patient begins care. If you’re late, Medicare reduces your payment for that patient’s care—by 1/30 per day. Wait too long (30 days), and you’ll lose the payment altogether.

The good news is that these notices are straightforward to complete. They’re essentially a notification with basic patient information like their name, Medicare number, and admission date. Build a system to ensure these submissions happen on time—this is one area where being organized really pays off.

4. Value-Based Purchasing: The Future of Home Health Payments

Home Health Value-Based Purchasing (HHVBP) rolled out nationwide on January 1, 2025. Unlike the current system, where payments are based on services provided, VBP ties reimbursement to patient outcomes. Agencies delivering top-notch care can earn bonuses, while those underperforming could see payment cuts.

This new model rewards agencies that focus on quality and measurable results. If you want to thrive in this new system, start preparing now. Focus on improving patient outcomes, track your quality metrics closely, and invest in training your staff to deliver the best care possible.

Your Roadmap to Avoiding Medicare Payment Reductions

Avoiding Medicare payment reductions boils down to staying organized and proactive. Whether it’s submitting OASIS and HIS data on time, listening to your patients through CAHPS surveys, or keeping your billing in order, every step matters.

Running a home health or hospice agency isn’t easy, but you don’t have to go it alone. Build strong processes, lean on your team, and stay ahead of the game. By meeting Medicare’s requirements, you’ll not only protect your revenue but also reinforce your agency’s commitment to providing excellent care.

If you're concerned about payment reductions, check out our article ‘Survey Prep vs. Readiness’ to help your agency stay compliant and ahead of the curve.

*Disclaimer: The content provided in this article is not intended to be, nor should it be construed as, legal, financial, or professional advice. No consultant-client relationship is established by engaging with this content. You should seek the advice of a qualified attorney, financial advisor, or other professional regarding any legal or business matters. The consultant assumes no liability for any actions taken based on the information provided.