How To File Home Health & Hospice No-Utilization Medicare Cost Reports

March 5th, 2025

5 min read

By Abigail Karl

If you’re a home health or hospice agency owner, you already have a long list of compliance tasks to manage. But when it comes to filing your Medicare Cost Report, one simple mistake—like missing a deadline or using the wrong form—could lead to payment suspensions.

The good news? If your agency had zero Medicare utilization in the previous calendar year, filing your cost report is much simpler than you might think.

The bad news? Many agencies assume they don’t need to file at all—only to get hit with compliance issues later.

You might be wondering:

- “What exactly is a No-Utilization Cost Report, and do I really need to file one?”

- “What forms do I need, and where do I send them?”

- “What happens if I miss the deadline?”

- “Do I need to use a professional when filing a No-Utilization Cost Report?”

At The Home Health Consultant, we’ve helped countless agencies avoid Medicare compliance pitfalls. We know CMS rules can be confusing, and we’re here to make this process as easy as possible for you.

In this guide you’ll learn:

- A step-by-step breakdown of how to file your No-Utilization Medicare Cost Report

- The exact forms you need (and where to submit them)

- Common mistakes that lead to rejection (and how to avoid them)

- Best practices to ensure smooth, stress-free compliance

By the end of this guide, you’ll know exactly how to submit your report correctly and on time.

Why Your Agency Must File a No-Utilization Cost Report

If your home health or hospice agency is Medicare-certified, you are required to file an annual Medicare cost report. This is true even if you provided no Medicare-covered services during the fiscal year.

The type of cost report for agencies that have not received reimbursements from Medicare is called a no-utilization cost report. Filing on time ensures compliance with federal regulations and prevents penalties such as payment suspensions.

If your agency fails to submit your cost report on time, Medicare will stop all reimbursements. This payment freeze lasts until the cost report has been both submitted and approved.

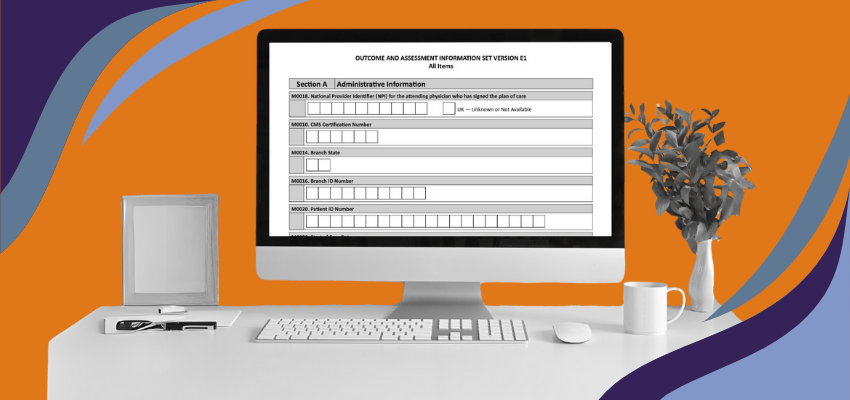

What Home Health & Hospice Agencies Need to Submit for a No-Utilization Cost Report

For a no-utilization cost report, your agency must submit two key documents to your Medicare Administrative Contractor (MAC).

- Certification Page (Worksheet S): This is the first page of the Medicare cost report form. This page serves as a cover sheet for your cost report. The certification page must be signed by an administrator or authorized officer. Examples of who typically qualifies as an authorized officer include:

- The agency’s Chief Executive Officer (CEO)

- The agency’s Chief Financial Officer (CFO)

- The agency’s owner (if Sole Proprietorship)

You’ll find an example of what the certification page for a home health agency looks like below. The yellow highlights indicate the required fields.

You’ll find an example of what the certification page for a hospice agency looks like below. The yellow highlights indicate the required fields.

- No-Utilization Statement/Letter: A signed statement confirming that your agency did not provide any Medicare-covered services or submit Medicare claims during the reporting period.

The no-utilization statement/letter must include the following information:

- Agency name

- Provider number

- Cost report period ‘from’ and ‘to’ dates: If your agency received provider number in the year that you’re filing for, the ‘from’ date is the date your accreditation with medicare is effective. This can be found on the letter notifying you of your provider number.

- Statement: “We have furnished no covered services and no claims for Medicare reimbursement will be filed for the period listed above.”

- Name, signature, title and date of the person signing the document

- Phone number and email address to contact the agency in case the analyst has questions

Some MACs provide a template for this letter, while a properly formatted version is acceptable with others. For example:

- NGS provides a specific "Low/No Utilization Cost Report Waiver" form

- Palmetto, Noridian, and CGS require a provider-created statement on letterhead.

See more on specific MAC no-utilization cost report instructions below.

If you’re unsure which MAC serves your agency, you can check using the ‘Who Are the MACs’ page on the CMS website. On this page, you’ll find the most up-to-date information on MACs and the areas they cover.

How, Where, and When to Submit Your Cost Report

You must file your no-utilization cost report within 150 days (5 months) after your fiscal year-end. You can send hard copies of the signed documents to your MAC’s designated cost report mailing address. Using certified mail or a courier service is recommended for tracking.

Pro Tip: Emailing or faxing cost reports is generally not accepted due to security and format restrictions.

Where to Find Your Home Health or Hospice Agency’s No-Utilization Cost Report Form

Finding the no-utilization cost report forms can be tricky. First you’re going to want to navigate to the official CMS Provider Reimbursement Manual - Part 2 website page.

Once there, simply scroll down, select your provider type, and you will download a .zip file. Once you open the .zip, you will be able to access the blank cost report form.

What Are the Most Common Reasons No-Utilization Cost Reports Get Rejected?

Several common errors can lead to rejection of your cost report.

- Failure to File: Even if you’ve received $0 in Medicare reimbursements, you must submit a no-utilization cost report. Missing the deadline can result in payment suspension.

- Missing Signatures: Ensure all required documents are properly signed

- Omitting the No-Utilization Statement/Letter: The signed letter is required to confirm no Medicare services were provided.

- Using the Wrong “From” Date: The biggest and no-utilization cost report error we’ve encountered, is using the wrong wrong ‘From date’. The ‘From date’ is located on the top right of the cost report form.

Your ‘from date’ should be your agency’s Enrollment Effective Date. You can find this date in the letter from your MAC notifying you of your Medicare enrollment.

- Using Incorrect Forms: Always use CMS forms designated for your provider type. While we’ve included links to and screenshots of the forms in this article, always check CMS for the most up-to-date information as the form versions can change from year to year.

- Late Submission: Missing the 150-day deadline can trigger compliance actions and financial penalties.

- Misclassifying Low Utilization as No Utilization: If your agency received any Medicare payments, even a single cent, you need to file a low-utilization report instead.

How Can Your Home Health or Hospice Agency Prepare for Filing Your Cost Report?

To ensure a smooth filing process, mark your calendar well in advance of the deadline. Please note that the MCReF system is not available for those filing a no utilization cost report. If you’re unsure of the kinds , verify that your agency had zero Medicare utilization by running your CMS Provider Statistical & Reimbursement (PS&R) report.

You should also double-check that all forms and attachments are accurate. It’s important to pay particular attention to the reporting dates and required declarations. Finally, always keep proof of submission by maintaining copies of all documents and submission confirmations.

Are there Differences Between States for No-Utilization Medicare Cost Reports?

While Medicare cost reporting requirements are federally standardized, each MAC may have unique mailing addresses or procedural preferences. Below you’ll find a list of the most common MACs and their resource pages on filing cost reports.

- CGS Administrators No-Utilization Cost Report Resources

- Noridian No-Utilization Cost Report Resources

- Palmetto GBA No-Utilization Cost Report Resources

- National Government Services (NGS) No-Utilization Cost Report Resources

- NGS provides a ‘Low/No’ Cost Report Waiver form

How Can You Stay Compliant When Filing Your Home Health or Hospice Agency’s No-Utilization Medicare Cost Report?

Filing a No-Utilization Medicare Cost Report might feel like an unnecessary bureaucratic hurdle. Regardless, it’s mandatory for all Medicare-certified agencies. By now, you understand:

- exactly what needs to be submitted,

- the critical deadlines,

- and how to avoid common mistakes that could lead to payment suspensions.

The last thing you want is to receive a compliance notice, payment freeze or unexpected penalty because of a simple oversight. Missing the deadline, using the wrong forms, getting the “from” date wrong, or forgetting a signature can all trigger costly delays or rejections. But now, you have the knowledge to file your report correctly the first time.

As your agency grows, so will your Medicare reimbursements. Next year you’ll likely be filing a low or full utilization cost report. To learn what your agency can do to stay ready for all cost reports, read our article on ‘The Different Types of Cost Reports’ by clicking below.

At The Home Health Consultant, we specialize in Medicare compliance for home health and hospice agencies. Our goal is to help you avoid penalties, streamline the filing process, and protect your agency’s financial health.

*This article was written in consultation with Mariam Treystman.

*Disclaimer: The content provided in this article is not intended to be, nor should it be construed as, legal, financial, or professional advice. No consultant-client relationship is established by engaging with this content. You should seek the advice of a qualified attorney, financial advisor, or other professional regarding any legal or business matters. The consultant assumes no liability for any actions taken based on the information provided.