Picture this: your team is seeing a complex diabetic patient twice a day. After 60 visits in a single 30-day period, you submit your claim—only to find Medicare won't pay for a big chunk of it.

Why? Because you hit the outlier cap.

If you own or manage a Medicare-certified home health agency, this scenario might feel familiar (and frustrating). Outlier payments aren’t always predictable. Misunderstanding how they work can cost your agency thousands each month.

In this article, we’ll break down:

- What outlier payments are

- How they’re calculated

- Special circumstances that trigger them

- And the 10% cap rule that can silently drain your revenue

Let’s make this complex topic clear, so you can make informed decisions about referrals, documentation, and your financial health.

What Are Outlier Payments in Home Health?

Outlier payments are extra reimbursements Medicare provides when your agency delivers unusually high amounts of care within a 30-day period.

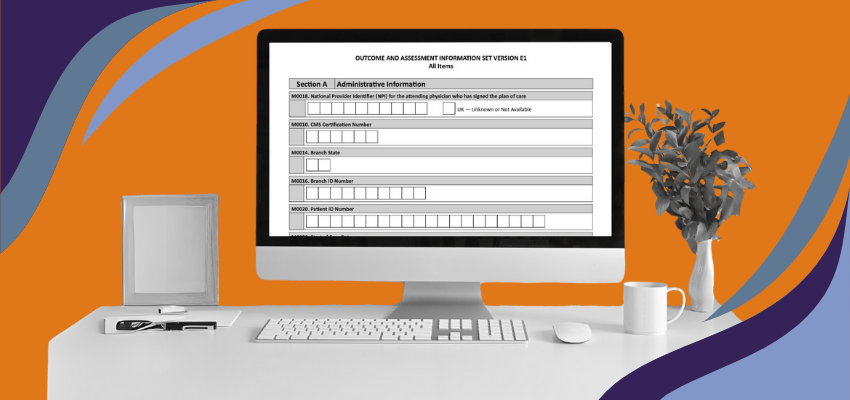

The Patient-Driven Groupings Model (PDGM) assumes most patients fall within an “average” cost range. But when the estimated cost of care far exceeds the standard payment (based on HIPPS codes and case-mix), Medicare steps in to cover part of the excess through an outlier payment.

Outliers are automatically calculated by Medicare, you don’t apply for them, and appear on the remittance with Value Code 17.

How Medicare Calculates a Home Health Outlier Payment

Here’s how the system works:

- Medicare estimates your costs for the period based on:

- Number of 15-minute service units billed

- Type of discipline (nursing, therapy, etc.)

- Geographic wage index

- It compares your estimated cost to:

- The case-mix adjusted base payment: the standard 30-day payment amount Medicare pays for a home health period of care after adjusting for the patient’s clinical characteristics.

- A fixed loss threshold amount: a set dollar amount added to the case-mix adjusted base payment to create the outlier threshold. It is the minimum additional cost an agency must incur beyond the base payment for the period to qualify for outlier reimbursement.

- If your cost exceeds that sum, Medicare pays a percentage (called the loss-sharing ratio) of the overage.

*Medicare only counts up to 8 hours (32 units) of care per day across all disciplines. Any time over that limit is excluded from the outlier calculation.

Common Clinical Scenarios That Trigger Home Health Outlier Payments

Not every patient generates an outlier, but here are real-life examples of where it often happens:

1. High-Utilization Diabetic Patients

- Daily or BID (twice-a-day) insulin injections

- Fun Fact: Many patient episodes that result in outlier payments are often for diabetic patients who need insulin injections once or twice daily, commonly referred to as QD or BID patients at home health and hospice agencies. This is because they are the most common kind of outlier patients.

- Especially common if the patient lives alone or lacks a reliable caregiver

- Can result in 30+ visits per 30-day payment period

2. Multi-Disciplinary Cases

- Patients receiving care from nursing, PT, OT, ST, social work, and CHHA

- Total visit volume quickly adds up

3. Rehab-Intensive Patients

- PT or OT three times per week or more

- Especially in post-surgical or neuro rehab cases

These are legitimate, medically necessary examples. But they do come with payment complexities.

Home Health 10% Outlier Cap: Why You Might Not Get Paid

Even when your claim qualifies for an outlier, there’s a hard stop:

Medicare will not pay outlier amounts that exceed 10% of your agency’s total PDGM payments in a calendar year.

Here’s what that means:

- If your base payment is $2,000 and the total claim is $5,000 (due to outlier visits), the outlier portion is $3,000.

- To receive that full $3,000, your monthly billing must be at least $30,000 (because 10% of $30,000 = $3,000).

- Please note that your cap is calculated annually, not monthly. We’re using the monthly example above, though it’s not how the cap really works, to illustrate an incredibly simplified example of how the outlier cap works.

- If your monthly billing is only $28,000, you might only be paid $2,800, and the remaining $200 gets held.

This withheld payment isn’t lost. It’s tracked and can be paid later through quarterly reconciliation if you fall back under the cap.

Special Circumstances That Push Home Health Agencies Over the Outlier Cap

Agencies don’t always know a patient will require frequent visits when they accept the referral. However, these patterns increase your risk of hitting the outlier cap:

- Taking on multiple daily-injection diabetic patients

- Specializing exclusively in high-visit disciplines (e.g., therapy or CHHA-heavy care plans)

- Prolonged certification periods with high visit frequency and no clinical discharge in sight

Before you accept a high-needs patient, run the numbers. Do they push your outlier ratio higher than your monthly billing can support? You can decide to accept the patient or not, depending on the agency’s financial situation and cash flow, marketing strategy, and the status of other patients resulting in outlier payments.

What Happens If the Outlier Goes Unpaid?

If your agency hits the 10% limit:

- The regular PDGM base payment is still paid

- The outlier portion is suspended (not denied)

- Medicare will attempt to pay the suspended amount later, if your future claims bring your agency back under the cap

Pro Tip: If your agency is constantly brushing up against this cap, it may be time to adjust your referral criteria, diversify your patient mix, or optimize your scheduling and care plans.

How to Stay on Top of Outlier Payments

You can’t rely on MACs to flag this for you.

To stay compliant and avoid cash flow surprises:

- Identify any patients currently receiving >30 visits in 30 days

- Check your MAC remittances for Value Code 17

- Calculate your agency’s current outlier % vs. total PDGM payments

CMS does not notify you when you're nearing your outlier limit. It’s up to you to monitor this internally.

Outlier payments aren’t just financial bonuses. They’re safety nets for legitimate high-need patients. But if you’re not watching the 10% cap, they can quietly cut into your revenue.

If you’re digging into billing and have more questions about what can affect your bottom line, check out our intro to ADRs article by clicking below.

*This article was written in consultation with Mariam Treystman.

*Disclaimer: The content provided in this article is not intended to be, nor should it be construed as, legal, financial, or professional advice. No consultant-client relationship is established by engaging with this content. You should seek the advice of a qualified attorney, financial advisor, or other professional regarding any legal or business matters. The consultant assumes no liability for any actions taken based on the information provided.

Topics: