What Is LUPA in Home Health & How it Affects Medicare Reimbursement

June 16th, 2025

4 min read

By Abigail Karl

Running a home health agency comes with enough surprises; reimbursement shouldn’t be one of them.

Yet many agencies find themselves underpaid for certain episodes of care and don’t realize why until it’s too late. One of the most common reasons? LUPA.

LUPA, or Low Utilization Payment Adjustment, can significantly reduce what you’re reimbursed under Medicare, even when your clinical care is spot-on.

In this article, we’ll break down:

- What LUPA actually means in today’s payment model

- How the visit thresholds are determined (and why they change)

- What “LUPA outliers” look like in the real world

- How your agency can prevent unnecessary LUPA claims

By the end, you’ll have the knowledge and tools to review your billing and referral process, knowing what to look out for with LUPA.

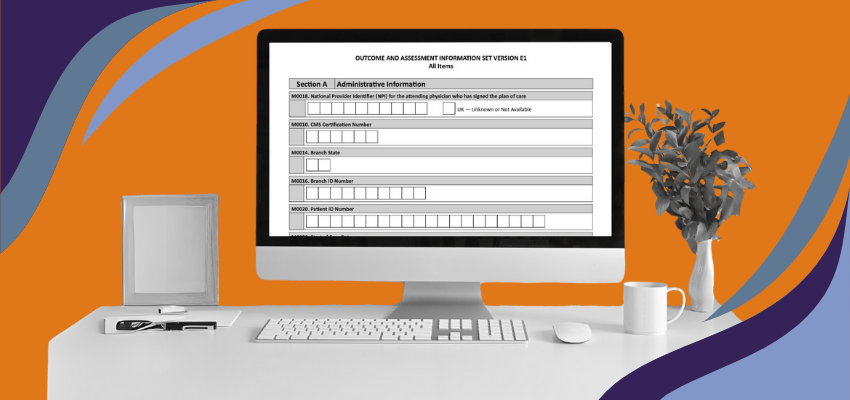

Understanding LUPA: What It Means in Medicare Home Health Billing

LUPA is a billing adjustment that applies when a home health agency provides fewer visits than Medicare expects for a given 30-day period of care.

Here’s the core idea: Medicare assumes a certain number of visits will be needed based on the OASIS assessment, diagnosis codes, and the HIPPS (Health Insurance Prospective Payment System) code generated.

If you fall short of that expected number of visits, your agency receives a significantly lower per-visit payment, not the full 30-day episodic payment.

So instead of being paid, for example, $2,500 for the full 30-day episode, you may receive a drastically reduced total, sometimes under $500.

Before 2020, under the old 60-day episode Home Health PPS, a LUPA was any episode with 4 or fewer visits in 60 days. Those were paid per visit.

In 2020, Medicare implemented the PDGM model and shortened the payment period to 30 days. Along with that change, LUPA thresholds became variable.

Now, each 30-day period has its own threshold that can range from 2 to 6 visits (depending on the patient’s case-mix group). If the total number of visits in the 30-day period is below that threshold, the period is a LUPA and is paid per visit. If visits meet or exceed the threshold, the agency receives the full case-mix adjusted 30-day payment.

How Medicare Determines Your LUPA Threshold for Each 30-Day Period

There’s no one-size-fits-all LUPA threshold. The specific LUPA threshold for a patient’s 30-day period depends on the patient’s case-mix grouping under PDGM.

This grouping reflects several patient and clinical factors, including:

- Primary diagnosis/Clinical grouping: Why is the patient receiving home health? (For example, wound care, diabetes management, physical therapy after a joint replacement, etc. PDGM has categories for these.) Patients in different clinical groups tend to have different typical visit patterns.

- Admission source & timing: Was the patient admitted to home health from the community or from an institution (hospital/skilled nursing), and is this an early period of care or a later (subsequent) period? Early post-hospital patients often get more intensive services initially, affecting the threshold.

- Functional impairment level: PDGM assesses the patient’s functional status (using OASIS data) as low, medium, or high impairment. A higher impairment level often corresponds to needing more visits (therapies, nursing) to meet care goals, so those cases may have higher thresholds.

- Comorbidities: The presence of significant secondary diagnoses can raise the complexity of care. PDGM assigns a comorbidity adjustment (none/low/high) based on whether additional conditions are present that typically require extra service. More complex patients might have a slightly higher visit threshold.

For example:

- A patient with minimal needs may have a LUPA threshold of 4 visits

- A more complex patient might need 5–7 visits to meet the threshold

If your agency provides even one visit below the expected number, the full episodic payment is forfeited.

Real-Life LUPA Examples That Impact Home Health Agency Payments

Let’s say you have a patient with moderate CHF (congestive heart failure) and the patient is post-hospitalization. Your EMR (Electronic Medical Record) software calculates that the patient needs at least 5 visits to qualify for the full episodic payment. Your agency completes only 4 visits due to a last-minute cancellation, and there is no rescheduling.

The result? You fall into LUPA territory and get paid per visit instead of the full case rate. Your total reimbursement could be cut by more than 50%, despite providing high-quality care.

Top Reasons Home Health Agencies Trigger Unintended LUPA Claims

Even compliant, high-performing agencies run into LUPA issues. Here’s why:

- Patient refusals or cancellations (especially around holidays)

- Staffing gaps or scheduling delays

- Misinterpretation of frequency orders

But knowing why LUPAs happen isn’t enough. Agencies need a system to catch and correct them before they affect reimbursement.

Special Circumstances That Lead to LUPA in Medicare Home Health

There are a few special circumstances that can lead to LUPA being triggered. These situations can be tricky to navigate and identify, so it's important to make yourself and your team aware.

SN-only Patients

A patient receiving only skilled nursing for wound care may have a low LUPA threshold, just 3 or 4 visits. But if a weekend nurse misses a scheduled visit, the claim slips into LUPA without warning.

Therapy-Heavy Patients

Therapy-heavy cases often assume higher visit frequencies. Miss a session due to therapist availability? You could trigger a LUPA unintentionally..

What to Do If a LUPA Has Already Been Triggered on a Claim

If a LUPA has already been submitted:

- Review the claim for accuracy

- Double-check visit documentation and frequency orders

- Work with your biller or consultant to verify that the correct threshold was used

If LUPAs are happening frequently, conduct a focused billing audit to identify where your process is breaking down.

Why Avoiding Frequent LUPAs Is Essential for Your Agency’s Financial Health

LUPAs aren’t rare—they’re one of the most common reasons Medicare-certified agencies don’t get paid what they’re owed. And it doesn’t take a major error to trigger one. A single missed visit or poorly understood threshold can tank your reimbursement.

This isn’t a billing mystery you need to solve alone. Once you understand how Medicare sets LUPA thresholds, and how to track them in real time, you can build systems that keep you protected.

Instead of scrambling after denials or short payments, your agency can implement a proactive process:

-

front load visits and frequencies,

-

flag at-risk episodes early,

-

tighten frequency monitoring,

-

and train staff to prevent revenue loss before it starts.

If you're not sure how to spot or prevent other types of payment reductions, don’t guess. At The Home Health Consultant, we help Medicare-certified agencies build systems that prevent under-billing and strengthen compliance.

To learn more about how to safeguard your revenue, check out our article on How to Avoid Medicare Payment Reductions below.

*This article was written in consultation with Mariam Treystman.

*Disclaimer: The content provided in this article is not intended to be, nor should it be construed as, legal, financial, or professional advice. No consultant-client relationship is established by engaging with this content. You should seek the advice of a qualified attorney, financial advisor, or other professional regarding any legal or business matters. The consultant assumes no liability for any actions taken based on the information provided.