What is an ABN in Home Health & Hospice (With Billing Instructions)

August 6th, 2025

5 min read

By Abigail Karl

When you think about Medicare coverage, you probably assume if a service isn’t covered, you simply don’t provide it. But what happens when a patient wants a service that Medicare won’t pay for – and you’re left wondering who’s responsible for the bill?

*This article was written in consultation with Mariam Treystman.

At The Home Health Consultant, we know how stressful it can be to balance Medicare rules with patient requests. That’s why we teach agencies how to use ABNs effectively to protect their bottom line and maintain patient trust.

In this article, you’ll learn:

- what an ABN is

- how it differs between home health and hospice

- why issuing them properly protects your agency from claim denials and compliance risks

What Does “ABN” Stand For in Medicare?

First, let’s define the basics. ABN stands for Advanced Beneficiary Notice of Noncoverage. It’s a written notice given to a Medicare patient before providing a service that may not be covered.

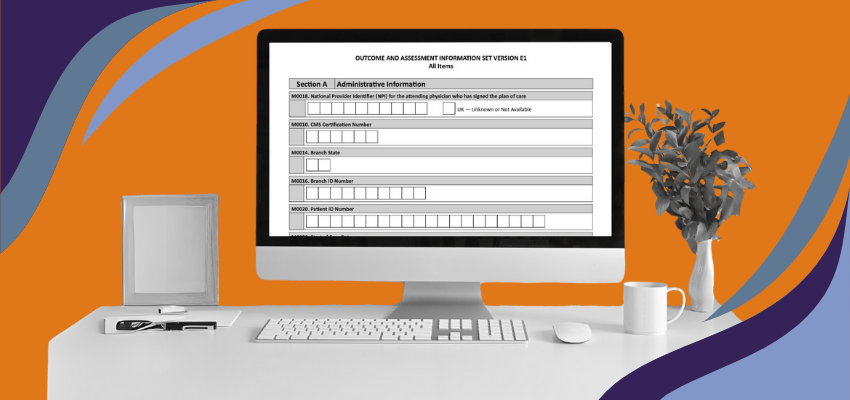

The specific form agencies need to provide applicable patients with, is form CMS-R-131 (as of August 2025). You can find this form linked on the CMS website on the Beneficiary Notices Initiative (BNI) page. You’ll also find an example of what the form looks like below.

Now that you know what an ABN is, let’s explore when exactly you’d use one in home health care.

What Causes You to Issue an ABN in Home Health?

In home health, ABNs come into play when a patient no longer meets Medicare’s coverage criteria for a specific service, yet they still want to continue receiving it. This most commonly happens with physical therapy services in home health.

To further clarify, an ABN should be issued when:

- You believe Medicare won’t cover a service (e.g., it’s not medically necessary, the patient is no longer terminally ill, or doesn’t meet coverage criteria),

and - You still plan to provide the service anyway.

Imagine a patient who has achieved all their physical therapy goals but insists on continuing visits for personal preference or comfort. You know Medicare will likely not cover additional visits, because the patient has already met their goals.

Your agency must issue an ABN before providing the additional care. Without issuing the ABN, if Medicare retroactively denies your agency will be responsible for the full cost.

***It is incredibly important to ensure that when you submit an ABN, the form is filled out in its entirety. CMS training on the form explains an ABN is valid if you:

- “Use the most recent version approved by the Office of Management and Budget (OMB)

- Ensure the entire form is completed

- Ensure the patient understands the notice

- Ensure the patient signs the form to confirm understanding”

You also need to keep the original completed ABN on file, and provide the patient with a copy.

Additionally, CMS training explains the situations in which ABNs remain effective. ABNs remain valid as long as long as there is no change in:

- “Care from what’s described on the original ABN

- The individual’s health status which would require a change in the subsequent treatment for the non-covered condition

- The Medicare coverage guidelines for the items or services in question”

ABNs aren’t about denying care. They are about ensuring the patient understands their financial responsibility before receiving care.

What Happens If You Don’t Provide an ABN?

If your agency provides a non-covered service without an ABN in place, you become fully financially liable. Medicare will deny payment, and you cannot bill the patient after the fact.

The risks extend beyond reimbursement. Consistent failure to issue ABNs properly can:

- Trigger Additional Documentation Requests (ADRs)

- Establish patterns of noncompliance

- Result in prepayment review of your claims

- Lead to provider termination in severe cases

As our co-founder, Mariam Treystman, explains it, “You really don’t want to test Medicare with ABN issues. You’re risking establishing a pattern of wrongful billing that can lead to prepayment review or worse.”

Understanding these risks is crucial, but knowing how ABNs differ between home health and hospice ensures your team uses them appropriately across programs.

How Are ABNs Different in Hospice vs. Home Health?

While the underlying purpose of an ABN remains the same in both home health and hospice, the circumstances of their use differ.

In home health, ABNs are generally issued within treatment when a specific service is no longer medically necessary, but the patient still wants it. For example, ongoing physical therapy visits after goals have been met.

The triggers for home health can include but are not limited to:

- not being homebound

- no longer needing skilled care

- receiving services not deemed medically necessary

In hospice, ABNs often occur upfront at admission. This is because hospice agencies must inform patients of any non-covered drugs or treatments before care begins. Additionally, ABNs in hospice may be used if a patient’s terminal condition improves and they no longer qualify for hospice services – although this situation is rare.

The triggers for hospice can include but are not limited to:

- The patient is no longer terminally ill

- A requested service isn’t medically necessary

- A higher level of care is no longer justified (e.g., inpatient care beyond the crisis period)

Recent CMS updates have emphasized the importance of notifying hospice patients about non-covered services in advance. Because these nuances matter, it’s important to differentiate ABNs from other required notices in your agency operations.

How Do You Properly Issue an ABN?

Properly issuing an ABN is critical to protect your agency. Before providing any potentially non-covered service:

Before providing any potentially non-covered service:

- Deliver the ABN before the service begins. Medicare requires that patients receive the ABN in advance. If the patient isn’t informed before services are rendered, your agency cannot invoice the patient later, even if Medicare denies the claim.

- Use the official ABN form. Fill in the service, the reason Medicare is expected to deny payment (e.g., not homebound, custodial care only), and a cost estimate. Don’t modify the form layout or use older versions.

- Explain it clearly and completely. This isn’t just a formality. A qualified staff member must explain what service may not be covered and why, in plain language. Patients should understand exactly what they’re agreeing to.

- Allow the patient to make a choice. They must select from three options:

- Receive the service and ask the agency to bill Medicare. If the claim is denied, the patient agrees to pay for the service out of pocket.

- Receive the service but pay privately, without billing Medicare

- Decline the service entirely

- Have the patient sign and date the form. If they refuse, document the refusal and have a witness sign. Without a signature, the ABN won’t protect you.

- Give the patient a copy and retain the original in your records.

Failing to follow these steps means your agency absorbs the cost, risking financial loss and compliance violations.

Using ABNs properly isn’t just about avoiding financial responsibility for an uncovered service. It’s also about ensuring your agency remains compliant and transparent with patients at every step of care.

What Happens After an ABN Is Issued in Home Health & Hospice: Billing Process Explained

Now that you know the scenarios that require an ABN, let’s walk through the actual process of billing and how patients can respond.

Once your agency decides to move forward with a service that may not be covered, the ABN must be issued before care is delivered.

Once patients receive an ABN, they can choose from the following options:

- Option 1: The patient wants the agency to try billing Medicare. If the claim is denied, they agree to pay out of pocket.

- *Billing note: You may collect payment upfront after the ABN is signed, but must refund the patient if Medicare ends up paying or the ABN was defective.

When submitting the claim to Medicare, you must use the GA modifier. GA modifiers let CMS know an ABN was issued to the patient before providing services. This way, if the claim is flagged in an ADR years later, you can appeal using both the original ABN issued and the GA modifier submitted with the claim.

- Option 2: The patient agrees to receive the service but does not want you to bill Medicare.

- *Billing note: You’ll bill the patient directly, and no claim is submitted to Medicare.

- *Billing note: You’ll bill the patient directly, and no claim is submitted to Medicare.

- Option 3: The patient refuses the service altogether.

*If a patient refuses to sign an ABN or choose an option, it’s generally recommended to not provide the requested service to protect your agency from an Additional Documentation Request (ADR) denial.

Understanding these choices helps your team guide patients through the process while protecting your agency from financial and compliance risks.

What’s the Difference Between ABN and NOMNC?

Many agencies confuse ABNs with NOMNCs, but they serve different purposes.

- ABN (Advanced Beneficiary Notice): Used within a treatment plan to inform patients about specific services that aren’t covered.

- NOMNC

(Notice of Medicare Non-Coverage): Issued when ending an entire course of treatment, such as at discharge from home health services.

Knowing which notice to issue ensures compliance with Medicare requirements and protects your agency. For a deeper dive into NOMNCs and how they differ from ABNs, check out our full article on NOMNC notices below.

*Disclaimer: The content provided in this article is not intended to be, nor should it be construed as, legal, financial, or professional advice. No consultant-client relationship is established by engaging with this content. You should seek the advice of a qualified attorney, financial advisor, or other professional regarding any legal or business matters. The consultant assumes no liability for any actions taken based on the information provided.

Topics: